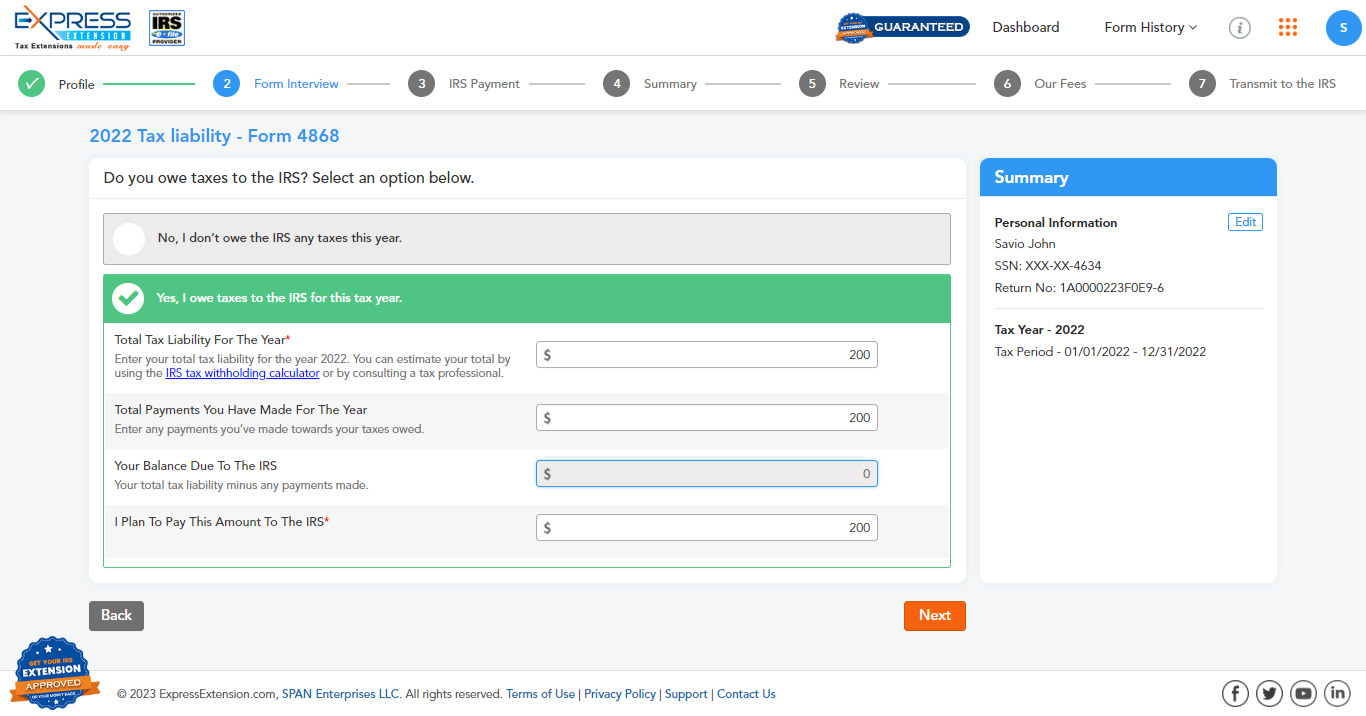

All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2018Ĭable News Network. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. "Even if you can't pay, make sure you file." There may be some fees involved, as well as any interest or penalty fees due. If you can't pay your taxes, you can apply to the IRS for an online payment program. It's always better to file your tax return (or file for an extension) and pay as much of your tax bill as you can afford over not filing at all.Īccording to the IRS: "The failure to file penalty is usually 5% of the tax owed for each month, or part of a month that your return is late, up to a maximum of 25%,"īy comparison: "The failure to pay penalty is. "The penalty for not filing is a lot worse than the penalty for not paying," says Kohler. If you happen to be procrastinating because you cannot pay the taxes you owe, skipping out on your taxes will only create larger problems later.īetter to be up front about your inability to pay. And there is no penalty for filing your taxes late if the IRS owes you money. Most Americans get refunds come tax day anyway. "If you don't file on time and don't file an extension, you increase the chances of an audit," says Kohler, "because the IRS doesn't know what you're up to."Īlso: extensions are not a terrible idea if you don't think you owe the IRS any money. But if you are still trying to find documents and pull together a return, the extra time can be a relief. Opting for an extension may be more trouble than it's worth, since you still have to pony up the money now anyway. "If you file for an extension and pay 90% of what you owe, there is no penalty," says Kohler.

#E FILE EXTENSION SOFTWARE#

"You can do a little bit of math, you can plug your stuff into tax software and get a rough idea of what you owe," says Mark Kohler, CPA and senior tax adviser at TaxSlayer.īased on the information that you have available, you will pay the IRS what you calculate your total tax liability for 2017 to be. The IRS won't give you more time to pay any taxes you owe.

Remember, when you file for an extension you're just asking for more time to finish the forms. IF I HAVEN'T DONE A RETURN, HOW DO I KNOW HOW MUCH TO PAY?

Many states offer similar extension options, with tax filing deadlines in October and November. 15, 2018 to file your taxes with all documentation. Once you've put in your extension paperwork you'll have six months to get your act together.

#E FILE EXTENSION FREE#

(To use the Free File Software to e-file your return, your adjusted gross income cannot exceed $66,000.) The free e-file applies only for requesting an extension.

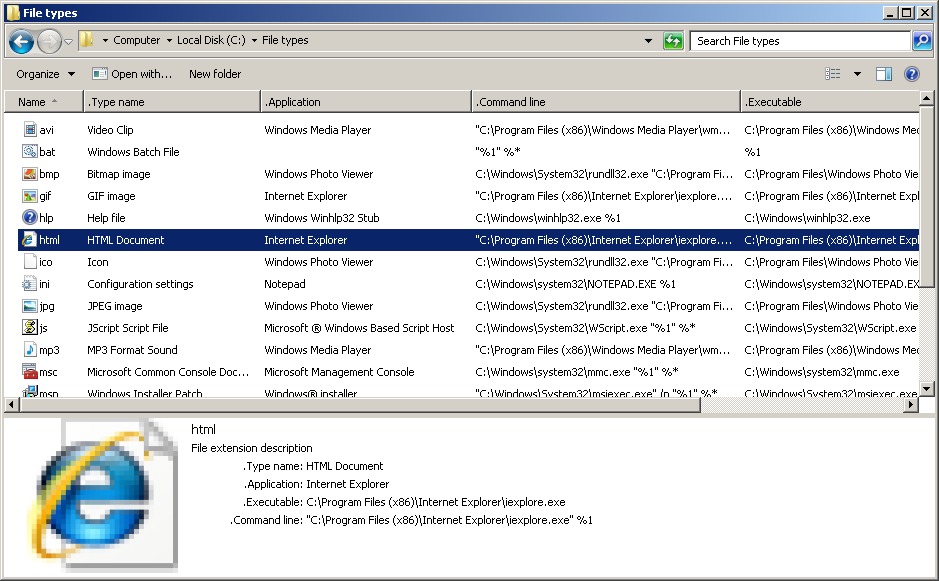

The IRS allows everyone to e-file for an extension using these free online services. You can mail in form 4868 or, much more conveniently, use e-file for the form.

0 kommentar(er)

0 kommentar(er)